We are thrilled to announce that our founder, Fiona Macrae, has been named MGA Professional of the Year at this year’s Women in Insurance Awards. This prestigious accolade recognises women excelling in professional, operational, or management roles within managing general agents, celebrating the leadership, innovation, and dedication required to make a real impact in the insurance industry.

Read more

October is National Cholesterol Month, a time to raise awareness and take small steps towards a healthier lifestyle.

If you are one of the many people living with high cholesterol in the UK, you are not alone. More than 53% of adults in England have cholesterol levels above the recommended guideline, and thousands successfully manage it every day through simple, practical changes to their lifestyle.* However, many people with high cholesterol have no obvious symptoms and may not realise their levels are raised.

Read more

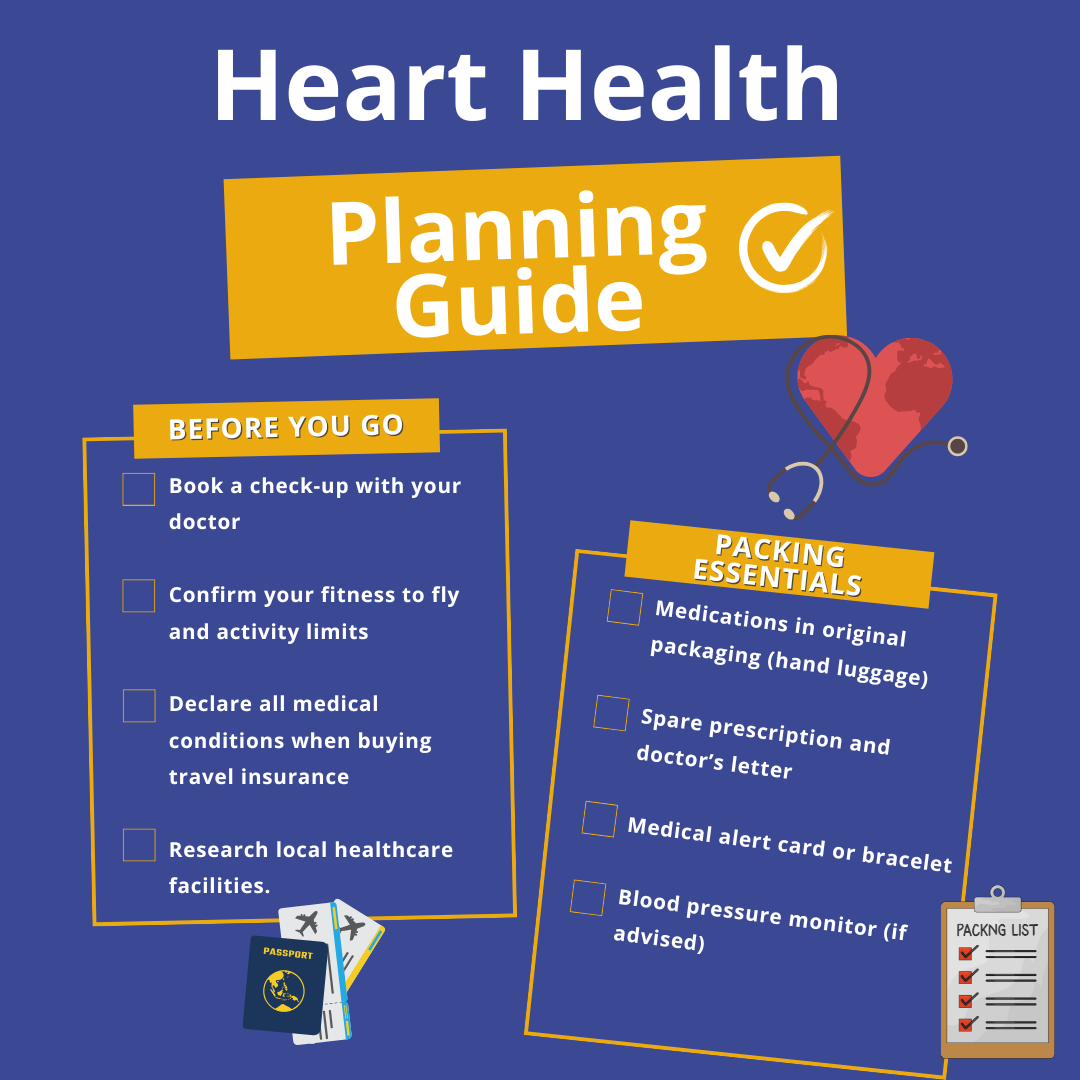

Planning a holiday when you have a medical condition can feel overwhelming — especially when it involves your heart or cardiovascular health. Whether you have been diagnosed with a heart condition, high blood pressure, high cholesterol, or you have experienced a heart attack in the past, the thought of travelling can bring extra concerns.

Read more

Gone are the days when Brits could simply jump on a plane and head to Europe for some sun and sangria. A new timeline has now been announced for the introduction of the EU’s Entry/Exit System (EES). The post-Brexit system was supposed to launch in 2022, but was rescheduled for May 2023 and then pushed back again.

Read more

September is Blood Cancer Awareness Month, a time to raise awareness of the different types of blood cancer and their symptoms. We will also be looking at the impact these conditions can have on everyday life. It’s also a chance to highlight that living with blood cancer does not mean putting your life – or your travel plans – on hold.

Blood cancers like leukaemia, lymphoma, and myeloma affect the production and function of blood cells. Each year in the UK, over 40,000* people are diagnosed with a form of blood cancer, making it one of the most common types of cancer. Despite this, awareness of blood cancers remains relatively low, which is why raising the awareness is so important.

Read more